When it comes to secondary markets, token projects have historically paid exorbitantly high fees to list on major exchanges. During the ICO craze of late 2017 through mid-2018, it was common for projects to allocate anywhere between $50,000 and $2,000,000 USD for exchange listings alone.

In this article, we’ll be examining Uniswap, a permissionless DEX that provides a new framework for token projects to offer liquidity using internal reserves.

Well-known exchanges, or those with what appeared to be a high amount of volume, were thriving off high premiums as token projects were desperate to find secondary liquidity for their private investors. In 2017, 435 projects raise capital through an ICO with an average raise of $12.7 million for a total amount of $5.6 billion1. Seeing as the average ICO was able to raise tens of millions of dollars in a matter of days (or sometimes even minutes), investors were begging for near-instant liquidity on their investment. To provide an even clearer example, virtually every project’s Telegram channel was filled with thousands of people asking “when Binance” or “when Coinbase”.

What Happened?

It should come as no surprise that many token startups could not meet the aspirations set by their investors and never saw listings on top tier exchanges. The last resort for many investors was to create their own liquidity by using decentralized exchanges like EtherDelta, where listings were permissionless. In essence, all you needed was someone on the other end to buy or sell the underlying token.

Despite absolutely horrendous user experience, EtherDelta still grew to prominence throughout 2017 due to this notion of permissionless liquidity. Any project or investor could easily add their token details (contract address, ticker symbol, number of decimals, etc.) and boom, a trading pair to buy and sell the asset was created.

Unfortunately for EtherDelta, the exchange faced an SEC lawsuit against the original founders in November of 2018. EtherDelta still lives on, (now known as ForkDelta) however, it does not get nearly as much volume as it did in its prime back in 2017 largely due to the terrible user experience.

Out with the Old, In with the New

In November 2018, a project called Uniswap launched what very-well may be the “killer-DEX” the community has long searched for. Uniswap is a decentralized exchange allowing for an automated, permissionless token exchange on Ethereum. The protocol is designed around ease-of-use, gas efficiency, censorship-resistance, and minimal rent extraction.

Uniswap has permissionless liquidity reserves that are 100% on-chain. There are no dependencies outside of the Ethereum network for the protocol to operate. This ultimately allows for anyone with an internet connection to trade any ER20 token, and more importantly, for anyone to integrate Uniswap functionality directly into their web3 product.

How Does It Work?

Trading on Uniswap is extremely straightforward. Simply connect your web 3 wallet (Metamask for example), select the token you wish to input and the token you’re looking to output. Uniswap displays a conversion rate based on the underlying liquidity pool and with one click a trade is automatically settled. This means not only do you never have to give up ownership of your funds, but you can know exactly what amount of tokens you’ll receive in an instant.

With Uniswap, you no longer have to worry about dealing with KYC/AML data privacy issues (or restrictions) to make a simple trade. The cherry on top is that users don’t have to worry about deposit or withdrawal minimums and lockups as well as pay significantly less on trading fees.

Similarly, creating a Uniswap liquidity reserve is also pretty easy. Liquidity providers deposit 50% of the value in ETH and the other 50% of the value in the ERC20 token into the token pool. In doing so, liquidity providers receive a tokenized share of their pool which entitles them to a pro-rate percentage of the 0.3% trading fees that are generated when the trading pair is used. Providers can liquidate their shares at any time using this link.

While this doesn’t seem very significant, the returns can add up over time if there’s sufficient trading on any given pool. As it stands today, liquidity providers can earn over 14% in annualized returns on the ETH/DAI trading pair. This is fairly significant as it outpaces DeFi lending platforms, like Compound, with lending rates of 4.24% APY on Dai or the S&P500’s 9.8% average annual return.

More impressively, these returns were calculated on Dai having $286,000 in 24h volume on Uniswap compared to US, centralized counterparts like Coinbase Pro which boast $1.7M in 24-hour Dai volume.

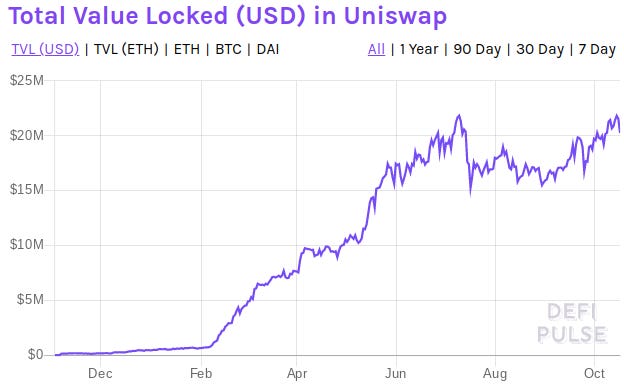

Despite the fact that Uniswap is still in its early stages, the exchange has grown to nearly $20M in total value locked since its launch nearly a year ago. Uniswap and DeFi have seen consistent growth in 2019. It has been the main narrative in Ethereum community as we begin to realize the network’s potential for open finance. With that in mind, we foresee Uniswap playing a bigger role in the overarching ecosystem as we discover new use cases of permissionless liquidity.

A New Framework for Token Projects

Now returning to our original thesis, rather than spending substantial amounts of capital on exchange listings, it seems logical for projects to re-allocate listing fee budgets towards building a liquidity pool on Uniswap. With this, tokens startups would no longer have to incur a sunk cost on listing fees and instead can shift that allocation towards working capital for the project. This capital is retrievable at any time (and in any increments) in the instance that the team needs it in the future.

Moreover, projects can worry less about wasting valuable resources towards coordinating exchange listing as they have a direct incentive for the community to trade the tokens on Uniswap.

As an example, let’s assume a token project raised $10M to fund the next two years of operations. They decide to allocate 5% ($500k) of the raise in ETH for a Uniswap pool, matched with their own treasury of tokens. With this, trading could happen within minutes or hours following the close of the sale and the project can begin to earn revenues on some of their capital.

Ultimately, by bootstrapping a liquidity pool with the capital from the raise, investors and projects are no longer reliant on the whim of centralized exchanges to list and dictate liquidity. Moreover, this is an improvement over previous iterations as now there’s a fairly reasonable barrier to entry for permissionless liquidity: capital and community. Without capital, there’s no liquidity. Without a strong community, the token is subject to dump or have little trading.

When promoting the Uniswap pool for all trading activities, not only is the token project earning revenues, it attracts other community members to become liquidity providers and earn a slice of the trading fees (further democratizing liquidity and reducing the circulating supply).

Liquidity Bounty Programs

Seeing as Uniswap is still a relatively new project, it is not surprising that most of its trading activity stems from well-versed, sophisticated crypto community members. With this in mind, it’s interesting to consider using bounty programs to incentivize community contributions to the liquidity pool.

Rather than offering a $10 airdrop that inherently results in selling pressure on the token’s trading pair, incentivizing support for the liquidity pool can help evangelize the market while earning the end-user a share of the trading fees.

Impermanent Loss Against Volatility

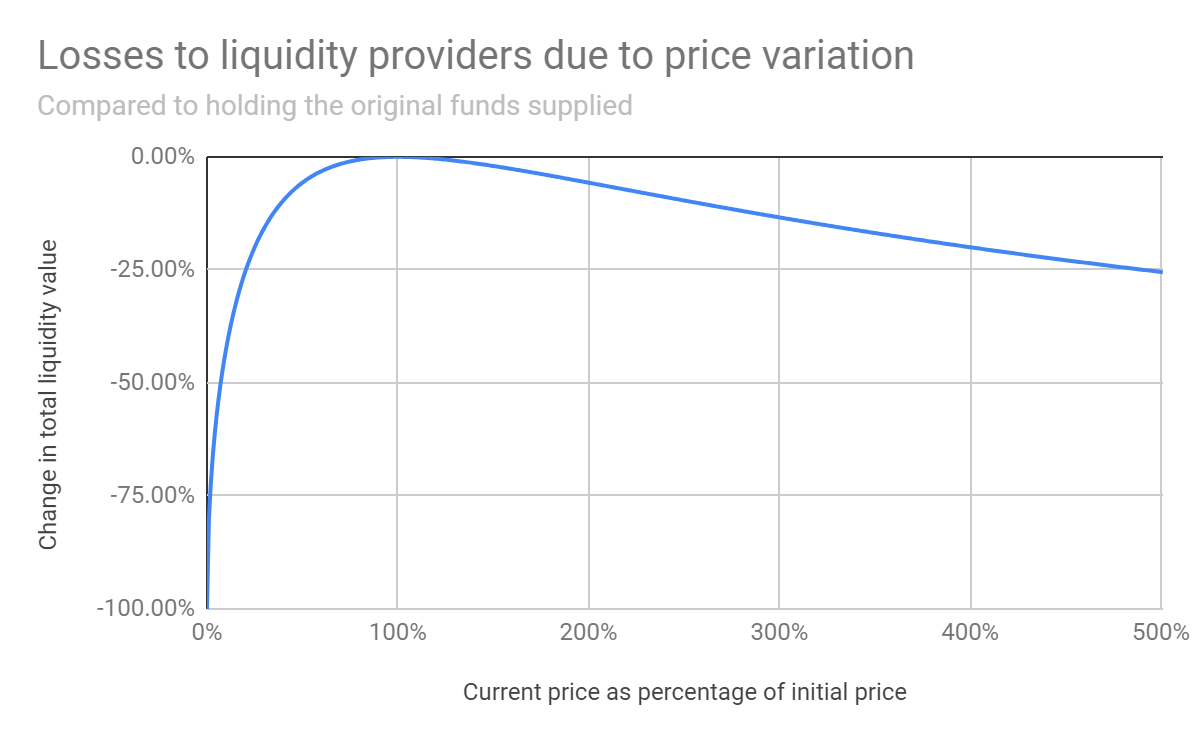

One of the major drawbacks with Uniswap is that price volatility can be a detriment to the fees earned from exchange trading. For those unfamiliar, losses from significant volatility in the trading pair is known as “impermanent loss”. If you’re looking to understand this mechanism in detail, we urge you to read this Medium post.

However, to get a brief idea of how impermanent loss can affect your pool returns, the graph below models potential losses strictly from price volatility. The graph can be read like a 500% price increase against the trading pair can result in a loss in value of 25% of your liquidity reserve.

Graph via Uniswap: A Good Deal for Liquidity Providers

With this, real returns for Uniswap liquidity providers can be calculated by taking the difference from impermanent loss and accumulated fees from exchange trading. While a significant downturn in the market could be costly, price volatility in a positive direction would likely offset the impermanent loss with value increases on other assets held outside of the liquidity pools (i.e. the project holds 10,000 ETH on their balance sheet).

While impermanent loss can be seen as a downside to this framework, we believe the tradeoff is largely mitigated by the avoidance of sunk cost on exchange listing fees in addition to centralization risks from using major centralized exchanges.

Other Drawbacks

As we’ve mentioned throughout the article, Uniswap is currently only available for Ethereum-based assets. While it is entirely possible to wrap tokens (i.e. converting assets of another blockchain to an identical Ethereum version), for the most part, this is a step that the large majority of native protocols (EOS, Tezos, etc.) will likely not be taking in the immediate future.

Similarly, creating an effective liquidity pool does require a large amount of ETH for the market to function properly. As we noted above, the providers must supply an equal amount of ETH and the ERC token for a pool to be created (or liquidity to be added). This means that unless the issuer has a reasonable amount of ETH (let’s say $10k or more) and access to a large reserve of tokens, then the liquidity pool will have no real liquidity. In short, the larger the liquidity pool, the deeper the amount of orders the pair will be able to sustain (and thus the greater amount of trading revenue assuming the pair is being used).

Finally, Uniswap is by no means alone in the greater DEX competition. With projects like Ren, Kyber, 0x and IDEX all looking to tackle similar segments, it’s likely that the race for the top DEX will only become more and more competitive once we start seeing serious interest in trading digital assets again.

Conclusion

To summarize, we believe liquidity pools on Uniswap are a fundamental first step token projects should take when considering how to provide liquidity to their early investors. While we do still think pursuing a select few reputable exchange listing (Binance and Coinbase being good examples) are always advantageous in the long-term, Uniswap is a great way to kick-off liquidity on your own terms.

As Uniswap continues to grow in the coming months (v2 being released soon), it will be important to watch if the project can gain enough traction to become a major contender with the exchanges we’ve all come to know to date. For a look at which Uniswap pools are garnering the most traction, please check out this tracking site.

In the meantime, if you or your business are looking to create your own Uniswap liquidity, please don’t hesitate to reach out for help!

Subscribe for More Content

Ready to get started?

Get in touch, or send us an email

About Us

Fitzner Blockchain Consulting is a leading management consulting firm that specializes in blockchain-based systems and their design