Welcome back to another edition of Token Tuesdays!

It’s been a while since we’ve last done this, but we’re back to our roots with a token pick. This time it’s one of the leading DeFi liquidity protocols – Kyber Network.

Kyber has seen a surge in fundamentals across the board, a Coinbase listing, and it’s set for an upcoming token economy rework which we believe will set a standard for token economic design in the future.

We’re stoked about this week’s edition so we hope you enjoy it.

Find out why we’re bullish on KNC.

Till next week,

–Lucas and Cooper

In the past year, we’ve witnessed a substantial amount of growth regarding the decentralized exchange ecosystem (herein referred to as DEXs).

You may recall us talking about projects like Unsiwap and Kyber – both of which offer very simple point and click interfaces to be able to seamlessly trade between any two Ethereum-based tokens.

In this article, we’ll be diving into the bull case for Kyber Network Crystals ($KNC) – the native token powering the sector leading Kyber Network.

Outside of the listings on notable exchanges like Coinbase, Kyber is gearing up for new and improved tokenomics in the form of the Katalyst network upgrade.

With Katalyst, the KNC token will represent both economic and governance rights over the protocol – a parallel seen with traditional equities.

Let’s first start by exploring what makes Katalyst exciting.

Introducing KyberDAO

The TLDR version of Katalyst is that Kyber will launch a native DAO in which users can earn rewards in ETH for participating in governance.

Rewards are distributed pro-rata relative to the frequency of a users participation and the amount of KNC being staked. With this in mind, Katalyst will introduce a direct demand for KNC through staking in tandem with exogenous rewards in the form of ETH which mitigate the sell pressure most networks suffer from issuing rewards in the same currency being staked (in this case KNC).

As for the governance itself, tokenholders will break down how the exchanges 0.3% trading fees are allocated across three important sectors:

- Rewards for governance

- KNC token burns

- Bonuses for liquidity provider

The sum of these three sectors amounts to 100%, and will introduce a crucial balancing act in which tokenholders dictate which of the three pools is most important at any given time.

The key takeaway here is that market makers will be further incentivized to provide liquidity while specialized knowledge providers can earn additional rewards by having smaller users delegate their voting power.

For more details on the interworkings of Katalyst and what you should know, check out this article.

Now while many people are pointing to Katalyst as the main driver of KNC’s recent run, we’d like to focus more on the fundamentals of the exchange itself.

Fundamentals

Over the past few months, Kyber Network has seen an increasing amount of usage. With DEX volumes soaring in 2020, Kyber (along with Uniswap) are clear leaders in the pack. In January 2020, Kyber led DEXs in total volume, reaching $66.5M in monthly volume followed by Uniswap with $62.1M. In February, DEXs surged again as Kyber reached $138M in monthly volume – a 109% increase month-over-month and leading the field in volume.

Last month, the liquidity protocol conceded its top spot to Uniswap with $215M in monthly volume. However, Kyber still broke new records as volumes topped $195M, another 41% increase in monthly volume. Generally speaking, the massive increase in volume via permissionless liquidity protocols like Uniswap and Kyber are key metrics to watch out for.

In short, the more trading volume on Kyber, the more KNC holders earn.

While USD volumes are one of most reported metrics, the protocol has also broke new records across a variety of other key fields including monthly trades and unique addresses. According to the most recent ecosystem report, roughly 11,000 unique Ethereum addresses interacted with the protocol across ~80,000 trades in the month of March alone.

The question now becomes, how does this increase in volume correlate to the price of KNC?

KNC Token Highlights

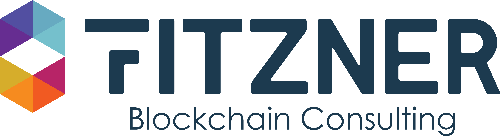

When looking at DeFi protocols, annualized earnings serves as one of the leading indicators for adoption, usage, fair value for the underlying tokens. According to Token Terminal, Kyber’s competitor Uniswap is the leader in annualized earnings, estimating roughly $10.5M in revenue as of writing. While Uniswap’s earnings are enticing, the protocol is untokenized and the only way to capitalize on those earnings is to become a liquidity provider for the protocol.

With that said, Kyber is a clear second in terms of annualized earnings with an estimated $5.26M in forecasted earnings this year. Unlike Uniswap, Kyber is a tokenized protocol where protocol earnings have some degree of an effect on the token’s fair value.

It’s important to note that earnings are calculated by extrapolating the past month in volumes. That said, Kyber is forecasted to earn roughly $5.26M in annualized earnings if the protocol’s trading volumes stay constant over the past 30 days.

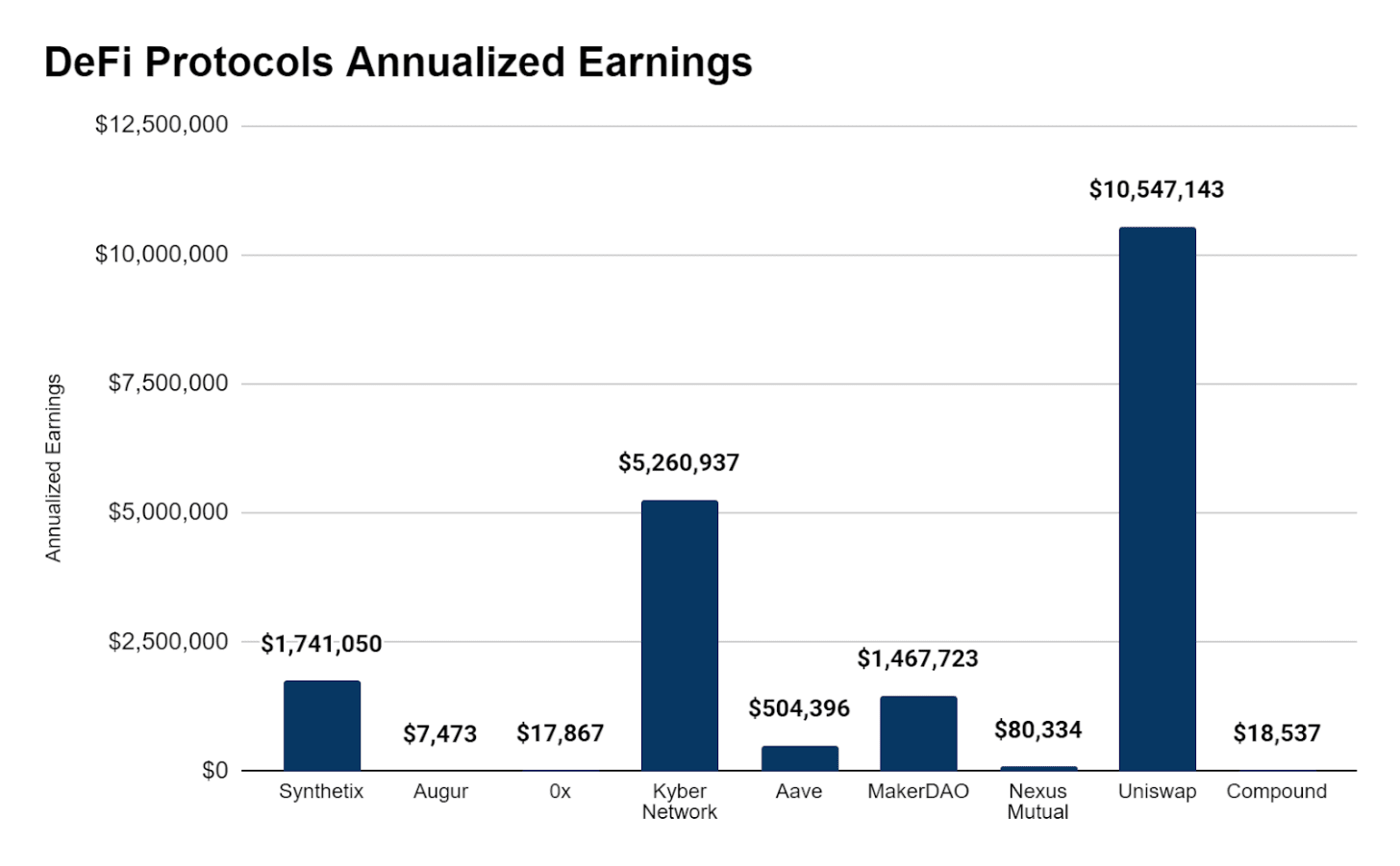

Now that we have an understanding of how Kyber stacks up with other DeFi protocols in terms of annualized earnings, we can now estimate how these tokens are valued based on their revenues by using one of the most prominent metrics in traditional finance for valuing capital assets – the Price-to-Earnings (PE) Ratio.

The PE ratio is a simple formula for understanding how investors value a company’s future growth expectations relative to its earnings. By definition, a PE ratio means that the market is willing to pay $x dollars for every $1 generated by the company. A company like Amazon, a high-tech growth stock, has a PE ratio of ~99, meaning the market is willing to pay $99 for every $1 earned by Amazon today.

For reference, the average P/E for the S&P 500 has historically ranged from 13 to 15

With that, a low PE ratio either means investors (1) have low growth expectations or (2) the asset is being undervalued. On the other hand, a high PE ratio means that investors (1) have high growth expectations or (2) the token is overvalued.

Given we’re looking at emerging permissionless money protocols that will act as the foundation for the next generation of finance, we can generally expect that there’s no shortage of “low growth expectations” from crypto investors.

So how does KNC stack up to the rest of the other money protocols in terms of PE ratios?

It boasts the lowest PE Ratio of only 20.23. The next is Aave with 57.57 while Synthetix and MakerDAO boast 80.85 and 225.95, respectively.

Simply put, by buying KNC today, you’re getting one of the best “bangs for your buck” on the market with respect to other tokenized DeFi protocols and earnings.

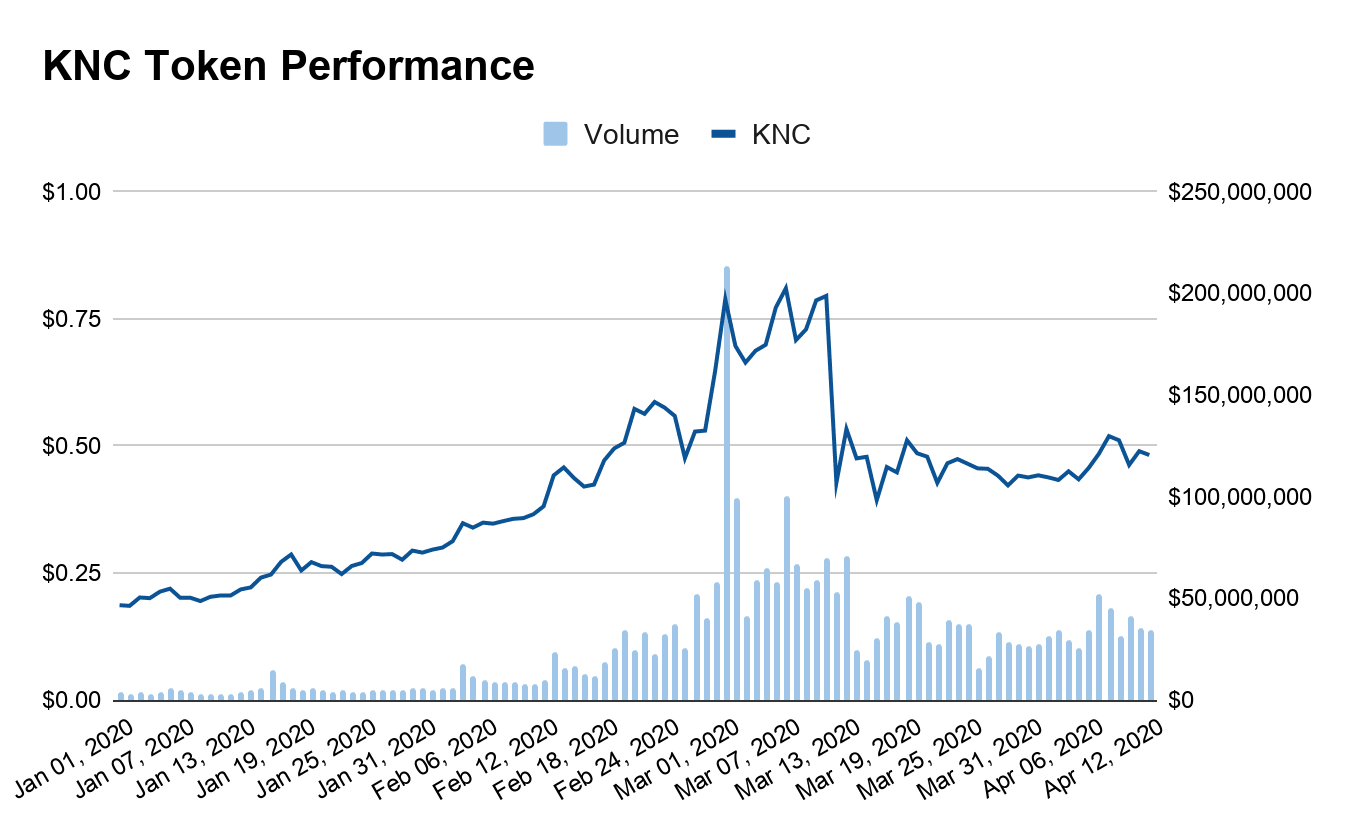

Looking at trading metrics, we can see KNC has performed very well year-to-date (YTD) in terms of price performance. Since January 1st, the price of KNC has increased from $0.19 to $0.48, resulting in a +158% YTD increase in 2020.

In terms of trading volume, the recent Coinbase listing has driven a near 10x increase in volume as average daily volume in January was around ~$5M. In March, trading volumes increased to $50M per day according to CoinMarketCap.

Closing Thoughts

Tying all these ideas together, we’re firm believers that projects with tangible revenue will have a promising future within the larger cryptocurrency ecosystem. The surge in Kyber’s fundamentals along with its sizable revenues combines for a compelling investment case for the liquidity protocol’s native token, KNC.

What’s unique about Kyber is that their revenue is now being funneled directly to tokenholders, largely thanks to the introduction of Katalyst and KyberDAO.

Building on our narrative from last week, we largely expect more projects to start routing protocol fees towards a DAO.

In the meantime, we encourage new users to gear up for the launch of Katalyst by joining the conversation via Kyber’s Discord.

Until then, we’ll be gearing up for a coveted pool master position upon the launch of the DAO!

Disclosure: Fitzner Blockchain is long $KNC. This article is not financial advice and we always encourage readers to do their own research and never invest more than they are willing to lose.

Subscribe for More Content

Ready to get started?

Get in touch, or send us an email

About Us

Fitzner Blockchain Consulting is a leading management consulting firm that specializes in blockchain-based systems and their design